Home » Study and live Abroad » Education Loan for studying abroad

Going abroad to study is a great opportunity to further your career and goals, as the quality of education abroad is incomparable. But many Indian students shy away from considering this opportunity as the tuition fees and the living expenses in foreign countries are very high.

To rescue students out of this situation, all the banks (both private and public), offer student loans for foreign studies. Getting a student loan is an easy task, you only need to know the process of application. It might seem a cumbersome and tiring process at first but with the right documentation and understanding of the process, things can move very fast.

Usually, parents and students feel that the education loan will only cover the tuition fees and that they must sponsor the rest. It is not true. The education loan can be availed to cover the following

The general eligibility criteria that are followed by all the banks are –

University Details

KYC documents of Student, Father, Mother or Sponsorer

Student Academic details

Student work Details

Income / KYC documents of Parents or Sponsorer‐ Salaried

Income / KYC documents of Parents or Sponsorer‐ Business/Self-employed

Property Documents

Overseas Education Loan interest rates vary from 9.5% to 14% depending on the kind of financial institution.

Servicing of monthly interest during the study period and the moratorium period is optional for students.

Few Nationalized Banks offer a 1% concession on the interest rate if the student starts paying a simple interest during the study period and moratorium period.

Collateral is an asset pledged against your education loan. It can be a tangible asset like a house or an intangible asset like a Fixed Deposit.

Banks and financial institutions ask for collateral to mitigate the risk. If a student fails to make the repayment of the education loan, the collateral is used towards the payment of the same.

A collateral security can be in the form of a house, flat, bungalow, non-agricultural land, fixed deposit, life insurance, etc.

It is important to understand the repayment terms and repayment schedule for your education loan.

Repayment starts only after the end of course. If the student gets employed within one year after the completion of course, the repayment will start immediately after one to six months from the date of employment (time varies from bank to bank).

If you are unable to secure a job within a full year of completing the course then repayment starts, irrespective of your employment status. Ideally, the repayment term varies between 3 years to a maximum of 15 years.

A longer tenure can reduce your EMIs, making repayments comfortable; while opting for a shorter tenure increases your EMI but you’ll be paying the interest-only for that period instead of the full tenure.

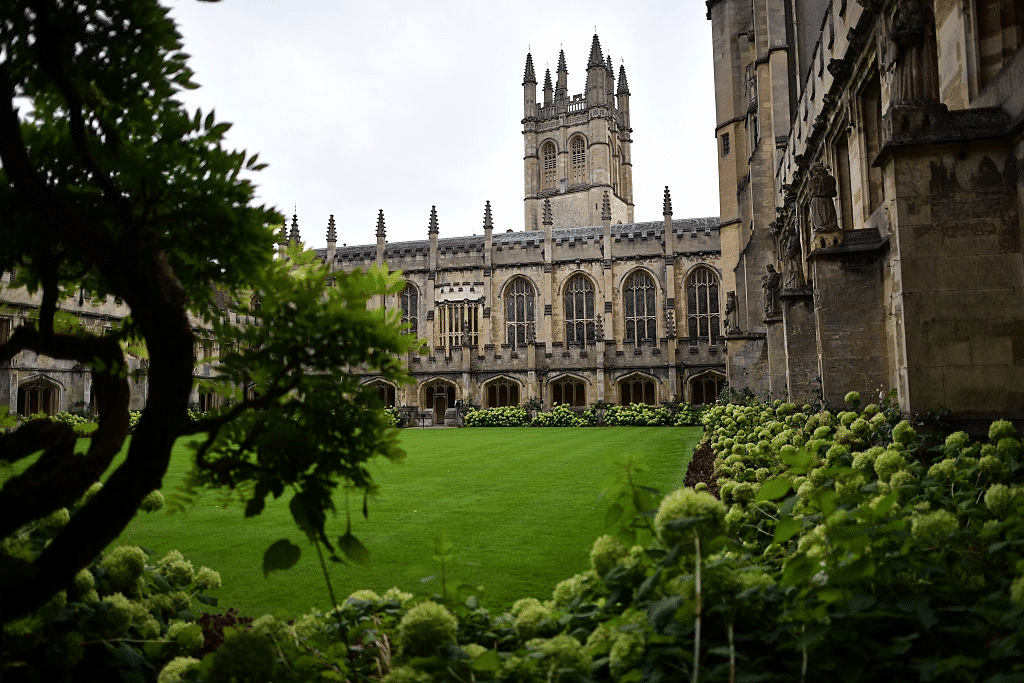

Which are the top-ranked universities in the world? Our guide to understanding and importance of ranking system

Here is a guide listing down steps with documentation guidance to make your abroad education journey easier.

Confused with selecting the right country? We help you out by giving you selection parameter and comparisons across countries

A top priority for every international student going abroad is the availability of the post-study work visa.

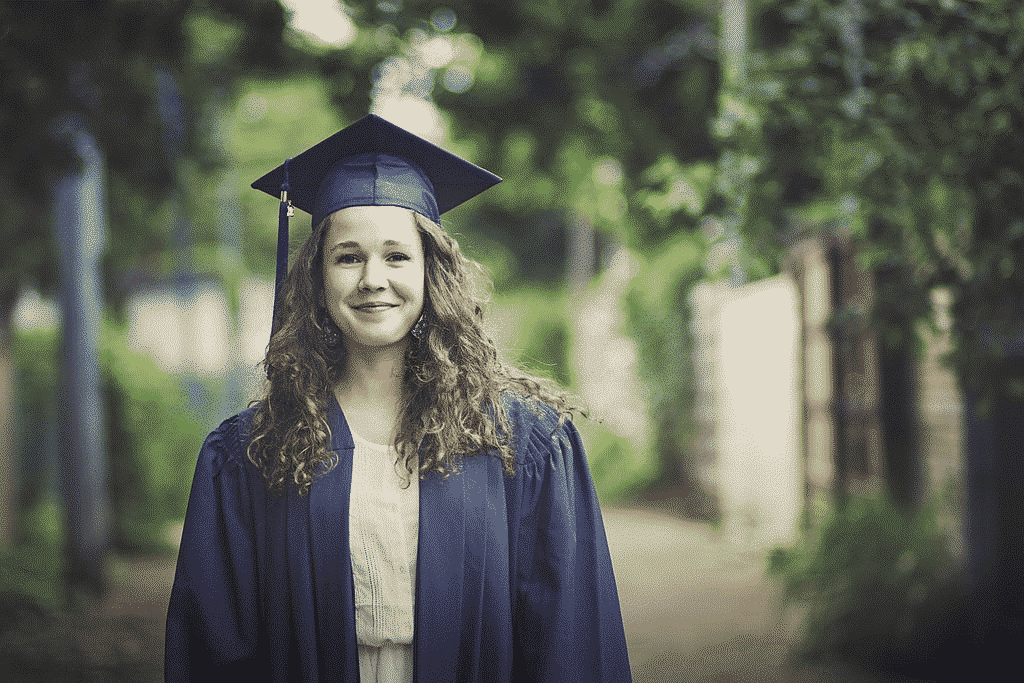

Find out why studying abroad can be a great decision and turning point in your career.

Depending on the country, university and the level and nature of the course you may be required to take one of the exams. Read more

I loved the in-depth analysis and varied career options provided by Amod. He assists at every step, starting from shortlisting career options to sending out applications to the best universities. I would recommend his consultancy to any student looking for overseas education.

Amod from ProAmica Career Development was really helpful, polite and patient while helping me find the right course and University.

I had a great counseling session with one of the team members. Absolutely loved the dedication and in-depth analysis, with a detailed explanation of the procedure. I would recommend to every student looking for studying oversees. 👍